|

HOME | SEARCH | ARCHIVE |

|

Regents approve retirement

plan improvement

Board votes to increase

age factors, nix tobacco stocks![]()

| |

|

24 Jan 2001 | The UC Board of Regents voted Jan. 18 to enhance the age factors used to calculate benefits provided by the UC Retirement Plan. These improvements will increase retirement benefits for faculty and staff who retire from the UC system in the future.

The retirement plan will be amended, effective Jan. 1, 2001, to reflect the new age factors. The measure, like several other retirement plan benefit improvements still under consideration, was designed to reward current employees and enhance the university's competitive position in recruiting future employees.

Sandra Haire, assistant vice chancellor for human resources, reported being "very pleased" with the regents' decision.

"In an environment where change has become the norm, I see this improvement as contributing to the quality and stability of our workforce," Haire said.

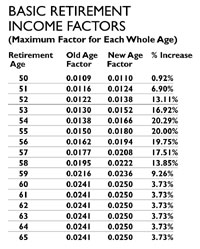

The new factors start at 1.1 percent at age 50 and increase in increments of .14 percentage points per year to 2.5 percent at age 60, remaining constant thereafter. Before the regents' action last week, the factors began at 1.09 percent for those retiring at age 50 and topped out at 2.41 percent at age 60.

Overall, the new age factors are between 1 percent and 20 percent higher than the previous factors, varying at each retirement age. The age factor is used to determine the percentage of an employee's highest average three-year salary the employee will receive from his or her pension after retiring. The age factor, multiplied by the employee's years of service, results in the percentage of monthly income to be provided in retirement.

"This improvement to our retirement plan is an important part of our efforts to reward faculty and staff for their years of service and to enhance UC's recruitment and retention of a high-quality workforce," said Judith Boyette, UC associate vice president for human resources and benefits.

The university faces a particularly tight labor market in California. Its retirement package is considered to be an important tool in recruiting faculty and staff, who in today's market tend to be both highly mobile and very aware of the components of "total compensation," including retirement benefits, when evaluating employment opportunities.

The new age factors are not expected to lead to a significant increase in retirements from the university, Boyette told the regents. Plan members who have delayed their retirements in recent months, in anticipation of these improvements, may account for a small initial increase. But by progressively increasing the age factors at older ages, she said, the plan promotes retention of current faculty and staff - providing higher retirement benefits to those who retire later. In addition, the maximum age factor, for those retiring at age 60 and above, has been increased from 2.41 percent to 2.5 percent.

The California Public Employees' Retirement System adjusted its age factors last year. Age factors for state employees in that system now begin at 1.1 percent, for those retiring at age 50, and reach their maximum level, 2.5 percent, at age 63.

The UC plan's age factor adjustments proposed by Office of the President and approved by the regents, Boyette said, were based on extensive consultation with union, faculty, staff and retirees' groups, and on the results of a comprehensive asset/liability study.

UC Santa Cruz Professor Michael Cowan, who chairs the systemwide Academic Council, noted that "many employees truly anticipate" an adjustment to the UC retirement plan similar to that adopted by state employees covered by CalPERS. He told the board that the council had studied various proposals for changing the age factors and, "in the interests of the university as a whole," had decided to "strongly support" the plan ultimately adopted by the regents.

Other retirement

actions, proposals

The regents also

approved a one-time, ad hoc cost-of-living adjustment to restore the purchasing

power of retirement benefits for UC retirees and survivors of active or

retired staff and faculty

. The regents' action restores purchasing power to the 85 percent level, effective Jan. 1, 2001, for UC retirees and survivors with retirement dates of July 1, 1985, and earlier. (Benefits for those who retired after July 1, 1985 continue to maintain a purchasing power above 85 percent.)

The university has provided such adjustments periodically to ensure that retirees' benefits are not significantly eroded over time.

At future meetings the regents may consider several other proposals for improving retirement benefits. Among them are measures to provide relatively equal value to all plan members, whether married or single, with regard to survivor benefits. The university is currently studying actuarial and legal implications of various proposals in this regard.

Other proposals relate to cost-of-living adjustments for retirees, increased portability of benefits, a shortened vesting period and a minimum benefit provision.

The regents recently approved a program extending retirement plan eligibility to qualified "casual" employees.

Tobacco stocks

The investments committee of the board of regents voted unanimously Jan.

18 to exclude tobacco stocks from the university's $52 billion investment

portfolio; their decision was confirmed by the full board the following

day.

UC faculty, retirees

and students - including UCSF Professor of Medicine Stanton Glantz, a

leading figure in the anti-smoking movement - spoke during the public

comment period, urging the board not to invest, as part of a plan to diversify

UC's holdings, in two index funds that include tobacco stocks.

Home | Search | Archive | About | Contact | More News

Copyright 2001, The Regents of the University of California.

Produced and maintained by the Office of Public Affairs at UC Berkeley.

Comments? E-mail berkeleyan@pa.urel.berkeley.edu.